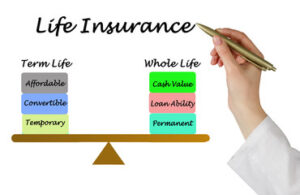

If you’re considering Life Insurance Arlington policy, the type you choose will depend on your family’s specific financial needs. Term coverage is simpler and more affordable but expires; whole-life policies offer lifelong protection and build cash value over time.

Both options require health exams, but whole life insurance often requires a more rigorous exam at renewals. This article will help you make the informed choice that’s right for your situation.

Cost

The type of life insurance you purchase is important because it affects your financial situation in a very real way. Term-life policies are typically cheaper than whole-life policies, making them more affordable for families with limited incomes. Whole-life policies, on the other hand, provide lifelong coverage and also accrue cash value over time, which can be tapped to cover unforeseen expenses or even to supplement retirement savings. However, whole-life premiums can be five to 15 times more expensive than term policies with the same death benefit.

In addition to the cost, another factor that influences whether whole or term life insurance is right for you is your family’s unique needs. Some consumers want a permanent safety net to protect their families from financial hardship and the potential for costly medical bills. Whole-life policies are often the most appropriate choice for this, as they offer a guaranteed death benefit that lasts a lifetime and only ends if you stop paying your premiums.

Many people also use whole life insurance to help pay for a funeral, provide income replacement in the event of a disability or estate taxes, or fund other special circumstances. Additionally, whole life insurance is frequently used in business succession planning to ensure the remaining partners can buy out the deceased partner’s equity stake in the company.

It’s important to note that you can’t have both a term life policy and a whole life policy at the same time. If you’re considering getting a term life policy, you should first check to see if your employer offers this coverage through payroll deductions as part of their benefits package.

Ultimately, your decision will come down to your specific goals and budget. If you need a temporary policy that provides peace of mind and helps cover financial liabilities, then term life is probably your best option. However, if you’re looking for an investment component that allows you to grow your money and access it at any time, then your whole life might be the best choice for you.

Benefits

The decision to purchase life insurance is a personal one that should be made based on a person’s family situation, financial goals, and long-term needs. A term policy will only cover you for a specific period, while whole-life policies are permanent and can offer a savings component as well. To decide which type of policy is right for you, consider the benefits offered by each and how they might fit into your financial picture.

Term life policies are designed to provide coverage for a specified period, typically 20 or 30 years. At the end of the term, your beneficiaries will receive the death benefit provided by the policy. However, if you die before the term ends, you will not be able to renew or replace the policy. In addition, if you choose to renew your term policy after the end of the term, you will need to undergo a health exam, which can be more expensive or may even result in being declined for coverage altogether.

Whole life insurance policies, on the other hand, will cover you for your entire lifetime and can also build cash value, which is money that the insurer invests on your behalf. This money grows tax-deferred and you can borrow against it or even surrender the policy for its cash value. This money can be a great tool for planning your finances, covering debt, and even supplementing your income during retirement.

Many people want the peace of mind that comes with knowing they will have coverage for their entire life. This is especially true for parents who plan to keep their children covered until they are adults or owners of small businesses who wish to ensure that heirs will receive the ownership stake they are entitled to upon the owner’s death. It is worth noting that some term policies do allow you to convert them to a whole-life policy within a certain timeframe, so be sure to review your options carefully.

The bottom line is that both types of policies have their pros and cons. The key is to assess your unique situation and choose the life insurance policy that aligns with your financial and personal goals.

Taxes

Many people choose whole life insurance because it provides a guaranteed death benefit for their entire lifetime as long as they pay premiums. However, there are a few things to keep in mind when choosing this type of policy. Some whole-life policies also offer a cash value savings component, which you can borrow against or withdraw from in the future. This is important to consider because withdrawing or borrowing against the cash value of your policy can lower your final death benefit.

Term life insurance has its advantages as well, especially for those with tight budgets and limited financial resources. Its affordability, flexibility, and customizable terms make it a good choice for many people. It’s also a great option for those who want to supplement their current savings or retirement plans with a little extra protection. However, it’s important to remember that you will eventually run out of time to pay your premiums and your coverage will expire.

Whole life insurance can be more expensive than a term policy with the same death benefit, and it requires you to commit to a lifetime of payments. It is also important to note that if you do not continue to pay your premiums, your policy will terminate and you will no longer have access to the death benefit payout.

Ultimately, both types of life insurance provide your beneficiaries with a lump sum that can help them cover debts and expenses, including funeral costs and other burial or estate planning fees. Regardless of which policy you decide to purchase, most fee-based (that is, non-commission-earning) financial advisors agree that it is smart to have life insurance in place to protect your family’s finances and future. The decision between a term or whole-life policy is primarily based on your needs and the amount of money you are willing to spend each month on premiums. The other key consideration is your health and lifestyle, since some hobbies or activities may impact your life insurance rates. For example, smokers are usually charged much higher premiums than non-smokers, and skydiving or rock climbing may also increase your rates.

Conversions

Depending on your situation, whole life insurance may make more sense than term life. However, it’s important to compare the prices of the two types so you can make the best decision for your financial situation. Term policies offer more coverage for your dollar, and they’re generally cheaper than whole-life insurance options.

Term life policies also have the advantage of being convertible, meaning you can convert them into whole life insurance policies later on. However, some insurers impose age or term limit requirements when it comes to this option. You’ll want to make sure that you have the option to convert your policy if you think it’s something you might be interested in down the road. In addition, you’ll want to look for term life policies that have a no medical exam requirement when it comes time to convert them.

While a term life policy is pure insurance, whole life policies also have a cash value component that grows at a guaranteed rate. This can be used to pay premiums, bank loans, or increase the death benefit later on. Because of this, whole-life policies can be more expensive than term policies with the same death benefit.

If your family’s needs have changed since you purchased your term life policy, converting it to whole life insurance may be a good idea. It will give you peace of mind knowing that your family will be protected for the rest of your life.

While it’s unlikely you’ll need to cancel your life insurance policy after a conversion, it is a possibility. If you’re not able to afford your current premiums, you can use the accumulated cash value in your policy to cover them, but this could cause your life insurance coverage to lapse. If you haven’t paid back the loan, the death benefit will go to your beneficiary. It’s also important to consider that the interest on the loan will be added to your overall premiums, which will increase the cost of your life insurance coverage. For this reason, it’s a good idea to only use the cash value if necessary.